Product data scraping vs API, how API access accelerates product availability discovery across networks

Product data scraping vs API is a strategic choice for affiliate leaders who care about speed, coverage, and governance. In affiliate commerce, availability changes drive revenue swings, so teams need fast and reliable signals when a product comes back in stock or when new variants appear across networks.

With API access to normalized product data from Affiliate.com, discovery becomes systematic. The platform unifies more than thirty networks, tens of thousands of merchant programs, and over a billion products, and it exposes identifiers and attributes that let you search, filter, barcode match, compare across currencies, and deduplicate results.

Definitions

Product data scraping means extracting information from web pages without a contract for structured access. It can be useful for research, but it is inherently brittle and hard to normalize at scale.

Product API access provides a documented schema and stable query surface. You request exactly the fields you need, get consistent types in return, and operate within clear rate and usage limits.

Why APIs accelerate availability discovery

Normalization at the source. APIs return structured fields such as barcode, SKU, MPN, ASIN, brand, category, currency, regular price, final price, discount, in stock, availability, merchant id, network id, commission url, and image url. Your system does not have to infer types from freeform page markup.

Identifier truth beats title guessing. Barcode level matching ensures that the same physical product is recognized across merchants even when titles differ. That removes near matches and makes cross network comparisons safe.

Layered filtering creates signal fast. Query the any field for broad recall, then layer brand, price band, currency, availability, merchant, and network. Sort by final price or discount. Turn deduplication on for a single canonical product, or off to show side by side merchant offers.

Scale without surprise. Documented pagination, limits, and sort orders make it trivial to sweep categories and monitor availability deltas. You can schedule incremental pulls instead of re processing entire sites.

Auditability and shareability. Shareable query links and Comparison Sets preserve the exact filters and identifiers behind a finding. Editors and analysts can verify in the live UI before publishing.

Impact on affiliate operations

Back in stock detection. Filter in stock equals true and last updated within a recent window. Because the data is normalized, the signal is comparable across networks.

Variant discovery. Combine brand and model with barcode or MPN to surface size or color variants that frequently hide behind inconsistent titles.

Cross currency integrity. Compare offers after matching on barcode, then evaluate final price in the shopper currency. This avoids false gaps that appear when currency converts are mixed with title matches.

Program governance. Constrain by network id and merchant id so discovery stays inside programs you are allowed to promote today.

What scraping struggles to deliver

Type consistency. Page structures vary by merchant and change often. Parsing brand, price, and availability into consistent fields requires constant maintenance and still yields edge cases.

True equality. Title or image similarity cannot reliably separate base products from bundles, refurbished items, or region specific variants. Identifier first matching solves this.

Combinatorial coverage. Scraping across many networks and merchants introduces uneven refresh cycles. APIs enable predictable scheduling and field level deltas.

Operational review. It is harder to hand a teammate a reproducible view with a scrape. With APIs, the query itself is the audit trail.

Fields that matter for availability work

When ranking or alerting on availability, prioritize these indexed fields and keep the payload focused.

- Identifiers: barcode, SKU, MPN, ASIN, product id

- Inventory: in stock, stock quantity, availability, commissionable status

- Pricing: currency, regular price, final price, sale price, sale discount, ship price

- Merchant and network: merchant id and name, network id and name

- Media and links: url, direct url, commission url, image url

- Attributes: brand, category, color, size, material, gender, tags

- Provenance: last updated

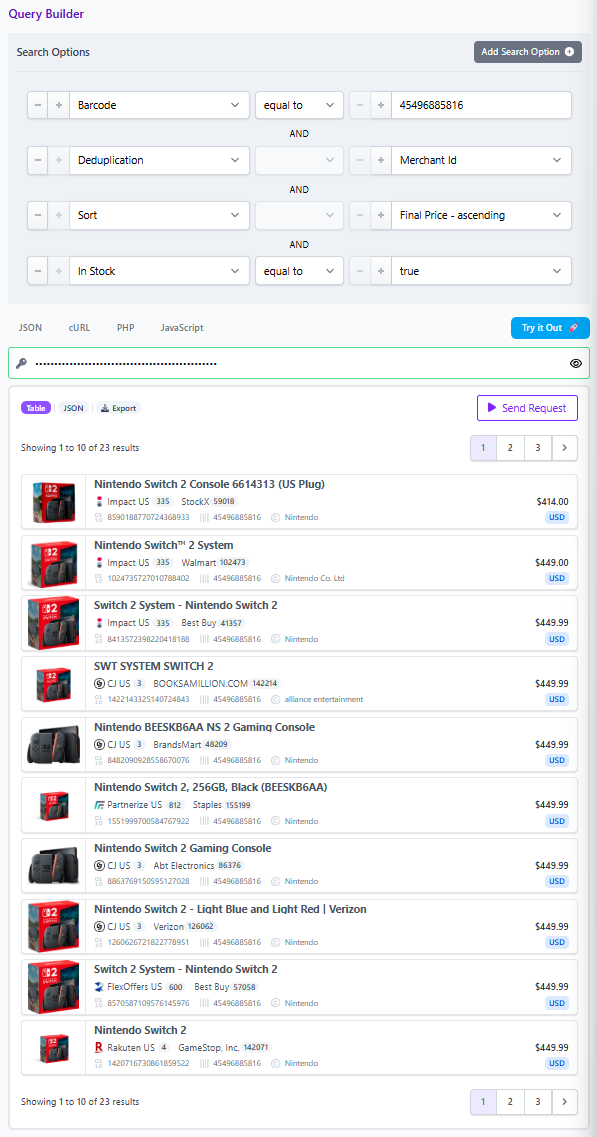

Flow example: from discovery to verified availability

Target item

Name: Switch 2 System, Nintendo Switch 2

Barcode: 45496885816

- Search with Any Enhanced for Switch 2 System, then filter brand equals Nintendo, in stock equals true, currency equals USD.

- Re run by barcode 45496885816 to anchor exact equality across merchants.

- Choose view, deduplication, confirm barcode, sort by final price, discount, in stock for a merchant offer table.

- Rank by final price or discount, then share a query link or a Comparison Set for editorial review.

Note prices and stock are at time of writing, confirm in the live UI before publishing.

Patterns for fast discovery with APIs

Discovery to decision. Use any for recall, then layer brand and availability, sort by final price, and trim to the fields you plan to display. Enable deduplication when you want one normalized product card, disable it when you want a merchant comparison table.

Identifier led scouting. Convert an input such as an Amazon ASIN to a barcode, then search by barcode across merchants. This isolates the exact item and removes title noise.

Program scoped watch lists. Persist queries with network and merchant filters. Share the link with editors so everyone sees the same governed results.

Decision framework

Ask these questions when choosing product data scraping vs API for availability discovery.

- Do you need to compare availability across networks using the same identifiers and attributes

- Can you bound results to merchants and programs you already work with

- Will your editors benefit from shareable queries and Comparison Sets for verification

- Do you require repeatable sort, pagination, and limits for scheduled monitoring

- Is cross currency comparison part of your editorial or merchandising workflow

If you answer yes to most, API access is the faster and safer path.

Risks and limits to account for

APIs carry rate limits, so plan pagination and incremental pulls. Semantic discovery on the any field is best used for opening the funnel, not for exhaustive lists. Always confirm prices and stock in the live UI before publishing, since values are at time of writing.

Ship it

Move your availability discovery to APIs and keep scraping for occasional research only. Connect your program to Affiliate.com, mirror your searches in the Query Builder, and promote the winning queries into scheduled jobs or Comparison Sets. Explore the programmatic APIs to operationalize this work at scale.